Learning how to deal with money while living abroad can be a challenging endeavor, requiring careful planning and strategic decision-making. So, here are our top 9 tips for balancing finances abroad to help you out. Whether you’re an expatriate, a student studying overseas, or an adventurous traveler, maintaining a balanced financial life is crucial to ensure stability and peace of mind. These tips will empower you to make informed financial choices and make the most of your international experience.

When relocating abroad, it is important to understand the local financial system, establish a budget, manage currency exchange, explore international banking solutions, minimize transaction fees, monitor expenses, plan for taxes, build an emergency fund, seek local financial guidance, and hire international movers for a smooth transition to your dream destination.

#1 Understand the Local Financial System

When moving abroad, it is essential to familiarize yourself with the local financial system to effectively manage finances at home when living abroad. Start by researching the local currency, as exchange rates can greatly impact your overall budget. Understanding the current conversion rates will help you make informed decisions when exchanging money or making international transactions.

Additionally, learn about the banking system and financial institutions in your host country. Different countries may have varying banking practices, services, and regulations. Familiarize yourself with the local banks, their offerings, and the process of opening a bank account as a foreigner. This knowledge will enable you to choose the right banking partner, access local financial services, and efficiently manage your funds while abroad.

Research the Local Currency, Banking System, and Financial Institutions

One of the first steps in navigating the local financial landscape while living abroad is to thoroughly research the local currency, banking system, and financial institutions. Start by understanding the currency used in your host country and familiarize yourself with the exchange rates. Keep track of fluctuations in exchange rates to make informed decisions about currency conversion, ensuring that you are getting the best value for your money.

Next, research the local banking system and identify reputable financial institutions. Find out about the requirements and procedures for opening a bank account as a foreigner. Different banks may have varying policies, fees, and services available, so compare their offerings to find one that best suits your needs. Additionally, consider factors such as accessibility, online banking options, and customer service.

Learn About Common Banking Practices, Fees, and Regulations

To effectively manage your finances abroad, it is crucial to understand common banking practices, fees, and regulations in your host country. Familiarize yourself with local banking terms, such as ATM (Automated Teller Machine) locations, wire transfers, direct deposits, and online banking services. This knowledge will help you navigate the banking system and carry out transactions efficiently.

Moreover, be aware of the fees associated with banking services. Banks may charge fees for various transactions, including ATM withdrawals, foreign currency exchange, wire transfers, and account maintenance. Understanding these fees will allow you to budget accordingly and seek out cost-effective alternatives if necessary.

Lastly, educate yourself about the financial regulations in your host country. Different countries have varying rules regarding taxation, reporting requirements, and foreign exchange controls. Stay informed about any legal obligations or restrictions that may impact your financial activities. Consulting with local professionals, such as tax advisors or expatriate forums, can provide valuable insights and ensure compliance with local regulations.

#2 Establishing a Budget Is a Must When Balancing Finances Abroad

Creating and sticking to a budget is crucial for maintaining financial stability while living abroad. It provides a clear roadmap of your income and expenses, enabling you to make informed financial decisions and avoid overspending. Establishing a budget allows you to prioritize your financial goals, allocate funds appropriately, and ensure that you can meet your needs and aspirations while living in and adjusting to a foreign country.

Assess Your Income and Expenses in the New Country

To create an effective budget after you’ve moved abroad, start by assessing your income and expenses in the new country. Take into account any changes in your income due to factors like exchange rates, taxation, or a different employment situation. Consider all sources of income, such as wages, scholarships, or investments.

Next, thoroughly analyze your expenses. Be mindful of any differences in the cost of living between your home country and the new country. Take into consideration rent or housing costs, utilities, transportation, groceries, healthcare, and other necessary expenses. It’s also important to include discretionary spending, such as entertainment and travel, but be realistic about what you can afford.

Prioritize Essential Expenses and Allocate Funds Accordingly

Once you have a clear understanding of your income and expenses, prioritize your essential expenses and allocate funds accordingly. Start by covering necessities like rent, utilities, food, and healthcare. These are the expenses that should take precedence in your budget to ensure your basic needs are met.

After addressing essential expenses, allocate funds to other categories based on your personal priorities and financial goals. This may include savings, debt repayment, education, travel, or entertainment. Be realistic about your financial capacity and avoid overspending in non-essential areas. Remember that living overseas often comes with unexpected costs, so it’s wise to allocate a portion of your budget for emergency expenses or unforeseen circumstances.

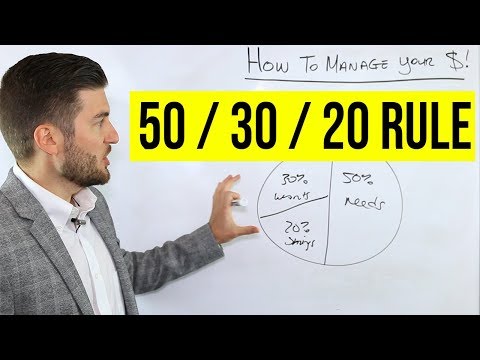

Creating a budget is only the first step; it is equally important to stick to it. Regularly monitor your spending and track your expenses to ensure you are staying within your budgetary limits. If necessary, make adjustments to your budget as you gain a better understanding of your financial situation and priorities. Watch this video if you want more advice on budgeting.

#3 Manage Currency Exchange

Managing currency exchange effectively is crucial when living abroad to optimize your financial transactions and minimize costs. Here are some useful tips to help you navigate the process:

- Before engaging in any currency exchange, it is important to have a clear understanding of the exchange rates and any associated fees. Exchange rates fluctuate constantly, so stay updated on the current rates to ensure you get the best value for your money. Compare rates offered by different financial institutions or currency exchange services to find the most favorable options. Additionally, be aware of any fees charged for currency conversion, as they can significantly impact your overall expenses.

- Exchange rate fluctuations can affect the value of your money when converting currencies. To minimize the impact of such fluctuations, consider using hedging strategies. Hedging involves making arrangements to protect yourself against adverse currency movements. For instance, you can explore options like forward contracts or currency hedging instruments offered by financial institutions to lock in an exchange rate for future transactions.

- Furthermore, consider the timing of your currency exchange transactions. Monitor exchange rate trends and try to exchange your currency when rates are in your favor. However, be cautious about trying to time the market perfectly, as exchange rates can be unpredictable. It’s essential to strike a balance between taking advantage of favorable rates and ensuring you have the necessary funds for your immediate needs.

#4 Explore International Banking Solutions

Exploring international banking solutions can offer numerous relocation benefits when managing finances abroad. Whether you are an expatriate, a student, or a frequent traveler, utilizing international banking services can provide convenience, cost savings, and ease of financial transactions across borders.

Research Banks That Cater to Expats

When moving overseas, it is advantageous to research and identify banks that specifically cater to expatriates or have extensive international banking services. These banks understand the unique needs and challenges faced by individuals living outside their home country. They often offer tailored solutions such as multi-currency accounts, international wire transfers, and expat-friendly services like language support to help with the language barrier and dedicated customer assistance.

Researching and selecting a bank with expertise in serving expat communities can simplify your banking experience and provide access to specialized services designed to meet your financial requirements while abroad.

Consider Opening a Local Bank Account to Facilitate Financial Transactions

In addition to exploring international banking solutions, consider opening a local bank account in your host country. Having a local bank account offers several advantages. Firstly, it allows you to receive payments in the local currency, which can be beneficial if you have local income sources or need to pay bills locally.

Secondly, it facilitates seamless financial transactions, such as paying rent, utilities, or local purchases, without incurring excessive fees for currency conversion. Local bank accounts also provide access to local banking services, including ATM withdrawals and online banking, making it more convenient to manage day-to-day financial activities.

When opening a local bank account, be mindful of the requirements and procedures for non-residents or foreigners. Ensure that you have all the important documents and understand any fees or minimum balance requirements associated with the account. It can be helpful to seek advice from expat communities, local forums, or banking professionals to navigate the process smoothly.

#5 Minimize Transaction Fees

To minimize transaction fees while managing finances abroad, explore banking options with low or no foreign transaction fees. Look for institutions that offer international accounts or travel-friendly cards with favorable fee structures. Utilize digital payment platforms like PayPal or TransferWise, which offer competitive exchange rates and low fees. These platforms often provide multi-currency accounts and prepaid cards, reducing currency conversion costs.

#6 Monitor and Track Expenses

Monitoring and tracking expenses is essential when living in another country. By actively keeping an eye on your spending, you can maintain control over your financial situation and make informed decisions. Here are some strategies to effectively monitor and track your expenses.

Utilize Budgeting Apps or Software to Track Spending

If you’re looking for solutions on how to document finances when living abroad, budgeting apps or software can be valuable tools for tracking your expenses while living abroad. These digital tools allow you to set spending limits, categorize your expenses, and receive notifications when you stretch over your budget.

Some apps even sync with your bank accounts or credit cards, automatically recording your transactions and providing a comprehensive overview of your spending habits. Utilize these apps to track your daily expenses, monitor trends, and gain insights into your financial behavior.

Regularly Review and Analyze Expenses to Identify Areas for Improvement

It’s important to regularly review and analyze your expenses to identify areas where you can make improvements. Take the time to examine your spending patterns, identify any unnecessary or excessive expenses, and consider alternatives.

Look for opportunities to cut back on non-essential items or find more cost-effective options. For example, you may discover that cooking meals at home is more affordable than dining out frequently. Additionally, scrutinize recurring expenses such as subscriptions or memberships to ensure they align with your current needs and financial goals.

#7 Plan for Taxes and Financial Obligations

Plan for taxes and financial obligations when living abroad to ensure compliance with local regulations. Research tax regulations and requirements in the host country, including residency rules, filing deadlines, and tax obligations for expatriates. Familiarize yourself with applicable tax rates, deductions, and credits. Seek professional advice from tax experts specializing in international taxation to ensure compliance and optimize your tax position. Professional guidance can help with tax planning, maximizing deductions, and minimizing liabilities.

#8 Build an Emergency Fund

Building an emergency fund is vital to ensure financial security. Allocate a portion of your income specifically for unexpected expenses or emergencies. Being in a foreign country can present unforeseen circumstances like medical emergencies or job loss. Aim to save a specific percentage of your income each month and automate the process.

By consistently setting aside money, you gradually build a safety net that covers at least three to six months’ worth of living expenses. Having an emergency fund provides peace of mind, protects you from financial hardship, and allows you to navigate unexpected situations confidently while living abroad.

#9 Seek Local Financial Guidance

Iit is essential to seek local financial advice and guidance on how to handle finances living abroad. Consult with financial professionals who specialize in international finances, as they possess expertise in the local financial systems, regulations, and tax laws. These professionals can provide personalized guidance on investment opportunities, tax planning, and wealth management strategies.

Additionally, seek recommendations from other expatriates or local residents who have firsthand experience navigating the financial landscape. They can provide valuable insights and recommendations based on their own experiences.

Hire International Movers to Help You Relocate to Your Dream Destination

In conclusion, hiring international movers is a valuable decision when relocating to your dream destination. Their expertise and experience in managing overseas relocations can alleviate relocation stress and provide you with a safe move. From professional packing services and shipping your belongings to navigating customs and immigration requirements, an international moving company can handle the logistics.

Their knowledge of international regulations and documentation ensures a smooth and efficient relocation process. So, contact us at Schmidt International Relocations and allow our movers to transport your belongings to your new home either with our moving services by sea or, if needed, by air freight.

FAQ

Should I Use Credit Cards or Cash for Daily Expenses Abroad?

The choice between credit cards and cash for daily expenses abroad depends on various factors. Credit cards offer convenience, security, and potential rewards but may incur foreign transaction fees. Cash provides a tangible way to manage spending but carries the risk of loss or theft. Consider a combination of both, using credit cards for larger purchases and cash for smaller transactions or in places where cards may not be widely accepted.

How Can I Transfer Money Between My Home Country and the Host Country Efficiently?

To transfer money efficiently between your home country and the host country, explore options such as bank transfers, international wire transfers, or digital payment platforms like PayPal or TransferWise. Compare fees, exchange rates, and processing times to find the most cost-effective and convenient method. Additionally, consider opening a local bank account in the host country to simplify transfers and reduce currency conversion costs.

What Should I Do With My Investments and Retirement Accounts While Living Abroad?

Managing investments and retirement accounts while living abroad depends on your individual circumstances. Options include leaving them as they are, transferring them to a local provider, or seeking guidance from a financial advisor who specializes in international investments. Factors such as tax implications, account accessibility, and long-term financial goals should be considered when deciding the best course of action.

How Can I Effectively Manage My Finances in a Foreign Country?

To effectively manage finances in a foreign country, understand the local financial system, research banking options, budget meticulously, track expenses, minimize transaction fees, plan for taxes, build an emergency fund, seek local financial guidance, and consider hiring international movers for a smooth relocation.

What Are the Best Strategies for Creating and Sticking to a Budget While Living Abroad?

The best strategies for creating and sticking to a budget while living abroad include assessing income and expenses, prioritizing essential expenses, exploring international banking solutions, utilizing budgeting apps or software, reviewing and analyzing expenses regularly, and seeking local financial advice. Aim to save a specific percentage of income each month and build an emergency fund for unforeseen circumstances.